Fellow Portrait

Nini Mao

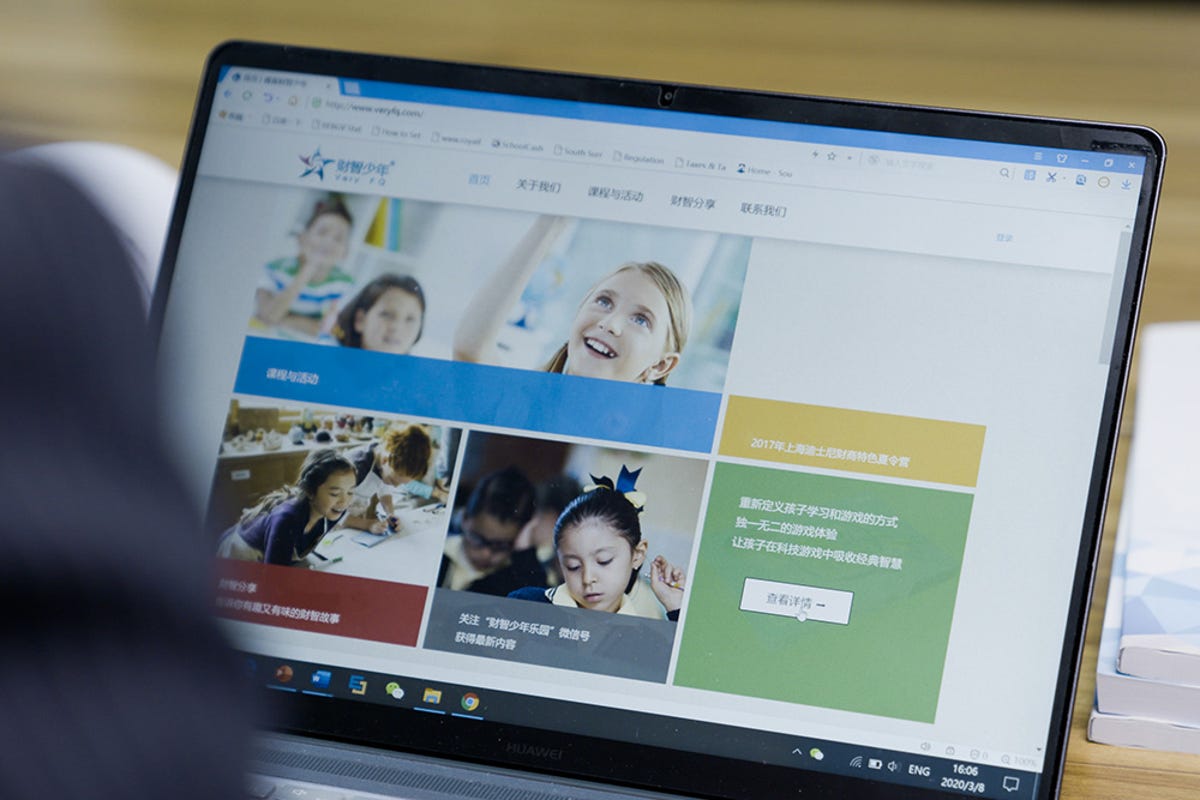

Very FQ

Very FQ delivers financial literacy education to Chinese families through workshops, audio programs, family games, books and practical tools.

East Asia

China

Fellow

2020

Updated March 2020

Skewed Values and Shame Around Money

In 2011, a 17-year-old in China sold his kidney because he couldn’t afford Apple’s coveted new tech gadgets. Sadly, he is now on dialysis after his remaining kidney became infected and failed. The man’s story may be unusual, but it highlights pervasive problems plaguing China’s booming economy: a skewed sense of the value of things and lack of knowledge about how to manage money.

These problems point to a deeper, underlying cultural reticence to discuss money and wealth. “In China, people are ashamed to talk about money,” says Nini Mao, who started Very FQ Educational Technology Corp., a financial literacy education company, in 2015. This reluctance, along with the financial illiteracy that has resulted, has far-reaching consequences. Every year in China, millions of families fall victim to financial crimes and loan frauds. Lack of financial literacy education—either in schools or by families—threatens family happiness, dampens economic growth, and worsens poverty.

Removing the Shame and Stigma Around Discussing Money

At the time she heard the story of the student who sold his kidney, Nini was already an experienced financial planner and head of UBS Business University in China. However, she says, tackling financial literacy “was a really important thing for me to do.” She used her finance industry experience and banking connections to start her company.

Very FQ provides financial literacy education to Chinese families through programs for parents and children using a culturally appropriate curriculum. It has gamified many topics, offering ten-minute audio programs and picture books that make learning easier. Educating children—especially young children—is a key part of the strategy; Very FQ offers programs for kids between age three and six. Nini says, “We found if you only provide training for younger adults, they already have pre-established values and an understanding of money.” In the past four years, for example, thousands of college students have used their naked pictures as collateral to borrow from loan sharks—money they used merely for leisure. While it is too late to educate these college students, educating children can not only prevent them from becoming victims of financial crimes as adults, but also enhance family financial literacy.

Very FQ takes advantage of the resources of wealthy families and the banking sector to bring financial education to poorer families who have basic financial literacy needs such as understanding the banking and loan systems. “We have two income streams in our business,” Nini says. “The banks will pay us to provide services. The second stream targets middle-class and affluent families.” Very FQ uses this income to provide financial education and materials to lower income families. For every three families paying full tuition, the company offers services for free to one family in poverty.

In addition to educating families about financial matters, Very FQ aims to remove some of the shame around money. Nini describes how children can feel embarrassed by such things as receiving a smaller amount of “lucky money” than their peers. This Chinese New Year tradition involves parents, grandparents, and friends giving children red envelopes containing cash. “There are stories about younger children who were ashamed that their parents gave them very little money. They go to school and do not want to talk about it.” Educating all children about true wealth and value can help ease the stigma.

People are ashamed to talk about money. Yet, as more and more families become wealthier, there is a growing need to learn how to manage one's finances.

Training Trainers to Broaden Very FQ’s Reach

In addition to developing program content, Very FQ trains and certifies educators, allowing it to multiply the impact of its 13-person Beijing- and Shanghai-based staff. “We have certified 3,000 trainers to work with families. They are our helpers. Otherwise, we couldn’t reach huge numbers of families.” Very FQ works with teachers and even bankers to provide financial literacy programs via schools, investor education seminars, internet audio programs, and roundtable salons.

More than 100,000 families in China have benefited from Very FQ’s educational programs, which are offered in 161 schools in 27 cities, and the company has distributed more than 120,000 educational books and games.

We spent two years developing all the content, publishing it and testing whether it works with families. This content development has not stopped since.

Fostering Society’s Well-Being

Nini believes that enhancing the financial knowledge and skills of Chinese families will enhance society’s overall well-being. Not only will it contribute to reducing poverty, but by enabling the next generation of Chinese citizens to make rational and beneficial financial decisions, Very FQ’s work will contribute to building a society that is not afraid to discuss finance, enabling a thriving and prosperous community.

Since 2018, we got into 52 elementary schools in Beijing and another 10 in Shanghai, providing regular training programs and classroom learning supplies.