Fellow Portrait

Sofie Blakstad

hiveonline

Helps underserved microbusinesses get credit and access markets they couldn’t normally reach by creating a trust history based on facts and business actions.

Europe

Denmark

Fellow

2020

Updated March 2020

Barriers to Borrowing--from Poor Roads to Distrust

Picture a place with little infrastructure and hardly any digital currency. To lend the equivalent of $40US to a microbusiness, a creditor would have to send a truck full of coins and bills bumping over muddy, rutted tracks for hours, accompanied by armed guards.

No traditional lender would do this, which explains why many African microbusinesses cannot obtain the money they need to grow. Even if loans are available, they carry excessive interest rates because of tricky logistics and high default risk.

In Niger, microbusinesses represent a huge percentage of commerce. These mostly rural, often women-owned businesses manufacture everything from anti-malarial creams to woven goods and rely on Village Savings and Loan Associations (VLSAs) for saving and borrowing. VSLAs usually consist of ten to 25 self-selected members who contribute to a fund that lends to individual members so they can grow their businesses. These “saving circles” can fund small projects, but microbusinesses operating outside the conventional monetary structure can’t obtain money from traditional lenders for larger initiatives. Economic trust measures like credit scores and borrowing history—critical factors for assessing loan suitability—simply don’t exist outside the formal financial system.

Our vision is to be the glue that helps bridge the formal and informal financial communities.

Building Trust One Meeting at a Time

Sofie Blakstad’s 25-plus years of experience with international financial institutions gave her insight into the barriers that microenterprises face when seeking capital. She incorporated hiveonline in 2016 to address these barriers. The company began by serving Danish businesses, but Sofie knew there was a greater need in Africa and soon pivoted to focus on Niger. Her background in programming, technology infrastructure, and banking enabled her to see how blockchain technology could be used to validate actions that build trust.

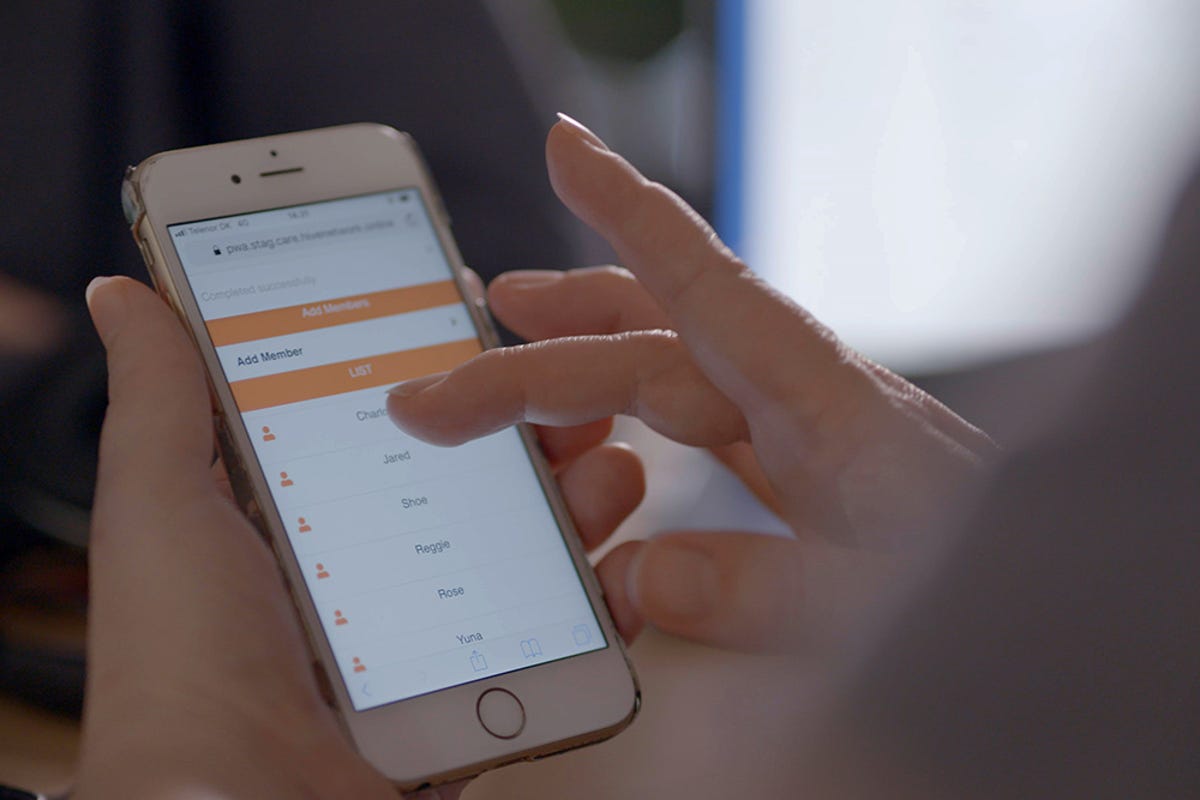

hiveonline digitizes the cash and the entrepreneur’s identity, giving small borrowers a way to prove themselves trustworthy. The blockchain-based hiveonline app includes an offline mode, runs on any phone with a browser, and measures micro transactions. Every VSLA activity—such as making a small payment or attending a meeting—earns trust that can be documented to demonstrate the entrepreneur’s reliability to a traditional lender. The trust-building runs in reverse, as well; lenders also are scored on reliability and treatment of customers.

I’ve been able to use an outsider’s vision of how finance and economics work. The productivity of most African countries is not measured in GDP.

Opportunity to Reach Millions

According to Sofie, sub-Saharan Africa today is home to about 100 million microbusinesses, with substantial growth projected over the next thirty years. The World Bank estimates that 350 million microbusinesses in developing countries currently have no access to banking. By accessing formal lending, businesses can grow beyond subsistence level and contribute public goods such as renewable energy, infrastructure, and education to their communities. The opportunity for hiveonline to effect change, based simply on the demographics, is enormous.

The impact on individuals is profound as well. A typical user of hiveonline’s app in Niger is a woman who has attended only a year of school and can’t read or write, has never used technology, has no access to electricity or running water, and yet supports five to 15 family members by selling goods locally. “When I have talked to these women,” Sofie says, “they have said ‘we want to sell to you!’ meaning they would love to trade internationally or in other parts of Africa. Using our platform, they have access to capital that would allow them to do that.”

Expanding in Africa and Returning to Europe

hiveonline is extending its reach by partnering with non-governmental organizations (NGOs). “Trust in banks is low everywhere, but especially in Africa,” Sofie says. Working with NGOs helps hiveonline reach new markets and enhances the all-important trust factor. The company is also expanding the application’s capabilities to hook into other e-commerce systems.

Today, hiveonline supports unbanked women micro-entrepreneurs in Niger who live on less than two dollars a day. The goal is to expand to more countries, focusing on Africa because it’s both the fastest growing and the poorest continent. “Currently, about 20 other NGOs want to work with our software to digitize community savings groups,” Sofie says. “We’re starting projects in Mozambique and other African countries, but our longer term vision is to bring the African community finance approach back to Europe.”

In Niger there are more people, mostly women, in informal savings networks—800,000—than in the entire formal banking system, which is only 700,000.